Multi-Role AI, Technology and Finance Company on Track for NASDAQ Listing and $1 Billion Annual Revenue Goal: iQSTEL, Inc. (Stock Symbol: IQST).

For more information on $IQST visit: www.iQSTEL.com.

Diversified Business with Divisions Focused on Telecommunications, Fintech, Electric Vehicles, Artificial Intelligence and More.

Powerful Growth Rate with FY2023 Revenues of $144 Million and a Forecasted $290 Million Revenue for FY 2024.

Positioned to Achieve $1 Billion in Revenue by 2027 Through Organic Growth, Acquisitions and High-Margin Product Expansion.

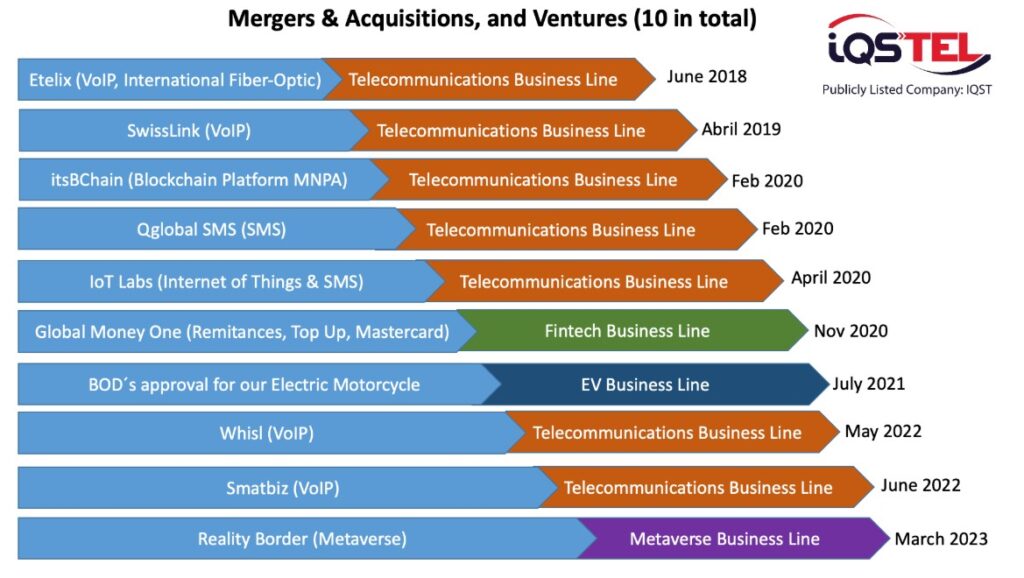

Completed 11 Acquisitions Since 2018 and Actively Pursuing More.

Stockholders’ Equity Met for Nasdaq Uplisting Requirements with Final Investment Bank Selection Underway to Guide Uplisting Process.

Introduced AI-Driven AIRWEB.ai and Preparing to Launch a Cybersecurity Solution in Q1 FY-2025.

iQSTEL, Inc. (OTC-QX: IQST) is a US-based multinational company in the final stages of the path to becoming listed on Nasdaq. With FY2023 revenues of $144 million and a forecasted $290 million in revenue, alongside positive operating income of seven digits for FY-2024 for their operating subsidiaries, IQST is positioning itself for explosive growth. The IQST mission is to serve basic human needs in today’s modern world by making essential tools accessible, regardless of race, ethnicity, religion, socioeconomic status, or identity. IQST recognizes that modern human needs such as physiological, safety, relationship, esteem, and self-actualization are marginalized without access to ubiquitous communications, financial freedom, clean, affordable mobility, and information.

IQST has been building a strong business platform with its customers, selling them millions of dollars per month, and by leveraging this trust, the company is now beginning to sell high-tech, high-margin products across its divisions.

IQST is strategically positioned to achieve $1 billion in revenue by 2027 through organic growth, acquisitions, and high-margin product expansion.

IQST Telecommunications Services Division (Communications): Includes VoIP, SMS, International Fiber-Optic, Proprietary Internet of Things (IoT), and a Proprietary Mobile Portability Blockchain Platform.

IQST Fintech Division (Financial Freedom): Provides remittance services, top-up services, a MasterCard Debit Card, US bank accounts (no SSN required), and a Mobile App.

IQST Electric Vehicles (EV) Division (Mobility): Offers Electric Motorcycles and plans to launch a Mid-Speed Car.

IQST Artificial Intelligence (AI) Services Division (Information and Content): Provides AI solutions for unified customer engagement across web and phone channels, along with a white-label platform offering seamless access to services, entertainment, and support in a virtual 3D interface.

IQST Cybersecurity Services: Through a new partnership with Cycurion, IQST will offer advanced cybersecurity solutions, including 24/7 monitoring, threat detection, incident response, vulnerability assessments, and compliance management, providing essential protection to telecommunications clients and beyond.

IQST has completed 11 acquisitions since June 2018 and continues to develop an active pipeline of potential future acquisitions, further expanding its suite of products and services both organically and through mergers and acquisitions.

Q3 FY-2024 Shareholder Letter Highlighting Record Growth, Strategic Expansion, and Nasdaq Uplisting Progress

On November 14th IQST announced the release of its Q3 FY-2024 Shareholder Letter, coinciding with the SEC filing of its 10-Q for the Q3. This letter showcases an extraordinary quarter marked by strategic growth, robust financial performance, and significant advancements toward the IQST long-term vision, including preparations for a Nasdaq uplisting.

The IQST financial and operational results for Q3 and the first nine months of 2024 reflect transformative growth and strategic expansion. With a profitable Telecom Division, a successful QXTEL acquisition, and a solid equity foundation, IQST is well-prepared for its planned Nasdaq uplisting.

The newly established IQST corporate financial planning department is set to work closely with company subsidiaries on a monthly basis, implementing a robust plan to drive bottom-line results starting in FY-2025. With a steadfast commitment from the Independent Board of Directors and strong investor support, IQST is on an accelerated path to becoming a $1 billionrevenue powerhouse by 2027.

The IQST Q3 Shareholder Letter highlights the following key developments:

Record Revenue Growth: IQST revenue for the first nine months reached $184 million, an impressive 89% year-over-year increase.

Ambitious FY-2024 Revenue Target: IQST aims for a record $290 million in revenue for FY-2024, with strong expectations for Q4, driven by its subsidiary QXTEL.

Profitability in Telecom Division: The IQST Telecom Division achieved solid profitability, generating $548,274 in profit for Q3 alone.

Strategic Cost Savings: A consolidation strategy within the IQST Telecom Division is expected to save up to $2 million annually.

Nasdaq Uplisting Progress: IQST stockholders’ equity has met Nasdaq’s minimum requirements, with final investment bank selection underway to guide the uplisting process.

Global Reach: IQST now operates with 100 employees across 20 countries, with six offices providing 24/7 support across 17 time zones.

Launch of High-Tech, High-Margin Products: IQST has introduced AI-driven AIRWEB.ai and preparing to launch a cybersecurity solution in Q1 FY-2025.

The IQST stable business platform now enables it to generate $2 millionin gross profit per quarter, paving the way for further bottom-line improvements through consolidation and the migration to a unified telecom platform.

Notably, in FY-2024, the IQST gross margin has shown consistent improvement, increasing from 2.68% in Q1 to 3.72% in Q3, a remarkable 39% increase within the year. This progress underscores the IQST focus on efficiency and profitability.

Stockholders’ Equity and Nasdaq Uplisting Readiness

IQST stockholders’ equity rose to $8.1 million, surpassing the minimum requirement of $5 million for a Nasdaq uplisting. IQST is in the final stages of selecting an investment bank to support this pivotal move.

IQST Innovation in High-Tech, High-Margin Products

IQST has built connections with some of the world’s largest telecommunications companies, generating millions in annual revenue. With these robust relationships, IQST is poised to expand its offerings, focusing on high-tech, high-margin products.

Cybersecurity: Collaborating with Cycurion.com to launch a telecom-targeted cybersecurity service in Q1 FY-2025.

AI Solutions: The recent launch of AIRWEB.ai has exceeded expectations, attracting strong interest with its free plan and positioning us as a leader in AI-enhanced telecom services.

Disclaimer and Disclosure: www.aibrandnetwork.com